Applicability of ITR-1

ITR 1 is applicable to person having: -

- Income from Salary and/or

- Income from One House Property and/or

- Income from Other Source like Interest

Documents Required to file ITR-1

- Form 16 received from Employer

- Take interest certificate from bank & Post Office (If you have interest income)

- Download form 26AS from portal which content details of TDS deducted by employer, Bank, Post & so on.

How to file Income Tax Return ITR-1

There are two alternatives to file ITR-1,

Alternative I: Download excel utility from Income tax portal and fill required details in excel form then generate an XML file and upload it on the income tax portal:

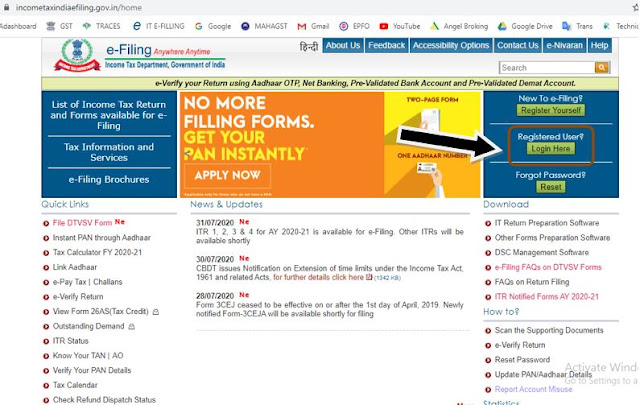

Step 1:For Downloading ITR form visit https://www.incometaxindiaefiling.gov.in website and click on “IT Return Preparation Software

Step 2: Select Assessment year and download excel utility

Step 3: Fill required details in excel file and generate XML file

Step 4: Login to https://www.incometaxindiaefiling.gov.in website

Step 5: Go to e-file tab and click on “Income Tax Return”

Step 6: Select Assessment year, ITR Form, Filing type, Submission mode then select income tax verification mode as Aadhar OTP if you have Aadhar registered mobile number with you otherwise select last option that is I would like to send signed ITR-V though post

If you have selected “I would like to send signed ITR-V though Post” then you need to take print out of ITR-V & sign the same and send it to following address:

Centralized Processing Centre, Income Tax Department, Bengaluru-560 500

Just you have to login to https://www.incometaxindiaefiling.gov.in website and fill details of your income online in “Prepare & Submit Online” section

Step 1: Login to https://www.incometaxindiaefiling.gov.in website

Step 2: Go to e-file tab and click on “Income Tax Return”

Step 3: Select Assessment year, ITR Form, filing type, Submission mode and click on continue

Step 5: Tick on I Agree Check Box and Click on continue

Step 6: Read General Instruction carefully and fill the required details

Step 7: After filling up all the details save draft and check all the filled details then click on Preview & Submit

0 Comments